Ecommerce Retention Rates Post-Lockdown. How These 5 Sectors Have Fared.

Whilst many online brands saw an increase in new customers during lockdown, have they managed to maintain them?

We examine the acquisition and repeat data from 5 sectors to find out.

At the start of this year, most brands were steadily chugging along the track of business growth.

Then Covid hit and, almost overnight, sent some hurtling up a vertiginous track at lightning speed.

Because a global pandemic meant people behaved differently. They went online and bought things they’d normally buy in-store (or wouldn’t buy at all).

Demand for multi-channel and ecommerce brands in sectors like home and garden, food and drink, and health and beauty rocketed.

These in-demand businesses hastily adapted. They turned stores into warehouses, polished their websites, pivoted their marketing strategies.

They were riding that rollercoaster to the top, taking in the spectacular views of new customers, referrals and online sales on the way.

But by early June, these brands had almost reached the apex. They were teetering up high, increasingly nervous about the drop ahead. The time to find out came on 15th June, when physical shops opened their doors once more.

Six weeks in, here’s how multi-channel and ecommerce brands in different sectors are performing.

Understanding the graphs

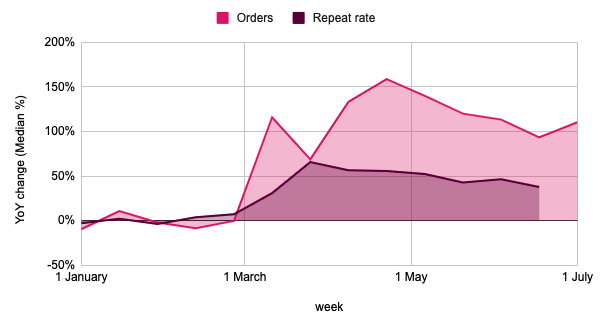

Before we start, a quick explanation of the graphs. Each presents the year-on-year change in online orders (the pink line) and year-on-year change in repeat rates (the purple line) for specific sectors.

The higher the line, the stronger the performance compared to the same time last year. If the line dips below 0, performance is weaker than the same time last year.

Now that's out the way, let's get on to the good stuff.

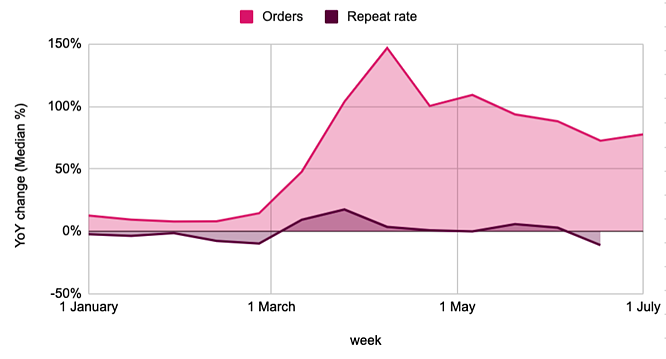

Home & Garden

Customer acquisition and online orders

During lockdown, home and garden brands were in high demand. In April, online orders for our clients in this sector peaked at +120% year-on-year (YoY).

On 13th May, garden centres reopened. By mid-June, online orders were declining.

But not all is as it seems.

It's not physical garden centres causing this decline, but another factor entirely: the weather.

Good weather has always correlated with more sales for garden brands. When the sun shines, people are inspired to finally grow that vegetable patch they’ve always dreamed of. When it rains, they go inside and watch Netflix.

After a steady dip in online sales during poor weather in mid-June, orders bounced back and continue on an upwards trajectory.

This trend is somewhat reassuring, hinting at a return to normality where regular factors, rather than a global pandemic, influence order volumes.

Garden centres reopening seems to have had little impact on online activity for our clients in the home and garden sector. At present, these brands are processing 78% more online orders and acquiring 71% more new customers YoY.

Repeat rate

Despite the repeat rate across our home and garden clients increasing by 20% during lockdown, customers are now less likely to repeat purchase than this time last year.

This could be because people are shopping for home and garden products in-store. But there are also other possible reasons for this decline.

One is that people have now adapted their homes to be comfortable places to live, work and play. While during lockdown they repeat purchased from brands to kit out various rooms, now there’s less need to return. Their homes have served their purpose for the past few months, they’re spending less time at home, and they can buy other things again, like takeaways or summer clothes.

Another is the economic climate. With many people on furlough, at risk of redundancy or out of work, they’re spending more consciously. Many home and garden products are big-ticket items. People want to feel financially secure before splashing out on a sofa or barbecue.

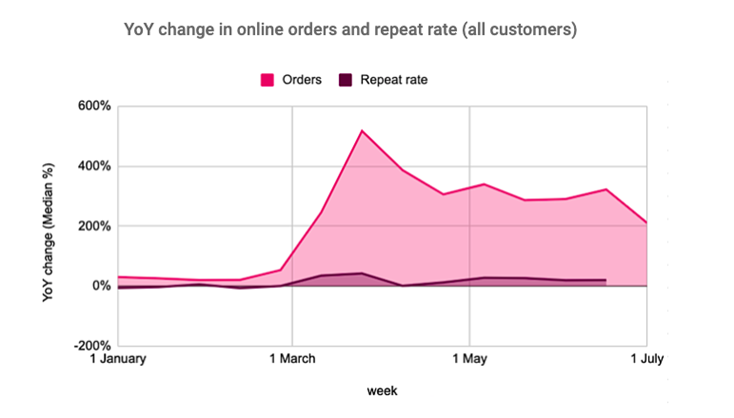

Food and Drink

Customer acquisition and online orders

As supermarket delivery slots and toilet paper became as elusive as Willy Wonka’s golden ticket during early lockdown, many consumers turned to online food and drink brands.

By late March, these businesses were acquiring 575% more new customers YoY.

While supermarkets have remained open throughout the pandemic, other factors have changed. Consumer confidence in the supply chain has returned, restrictions on leaving the home have eased, people’s attitude towards the virus has evolved (less panic, more ennui).

It’s worth noting that online food and drink brands are not competing with supermarkets. They offer a specific service, such as vegan food delivery or gin subscription, rooted in quality and convenience. New customers acquired during lockdown likely saw these brands as an interim solution until they could return to weekly supermarket shops and meals out.

So it’s not a surprise that online orders and customer acquisition have declined since lockdown. Yet it does make it even more remarkable that online orders remained strong (at around +300% YoY) until mid-June. Since then, they've declined in a trend set to continue now that restaurants and shops have re-opened.

Repeat rate

At its peak, the repeat rate across our food and drink clients sat at +43% YoY. This is now staying steady at +20%.

Shopping at the local supermarket and eating out are activities ingrained in most people’s lifestyle. Buying food entirely online feels like a much bigger change than buying all our clothes online. The decline in online orders, both new and repeat, since April reflects this.

But that doesn’t mean brands in this sector shouldn’t prioritise customer retention. Given the huge surge in acquisition during lockdown, these brands can sustain impressive growth if they turn even just a small proportion of new customers into loyal brand advocates.

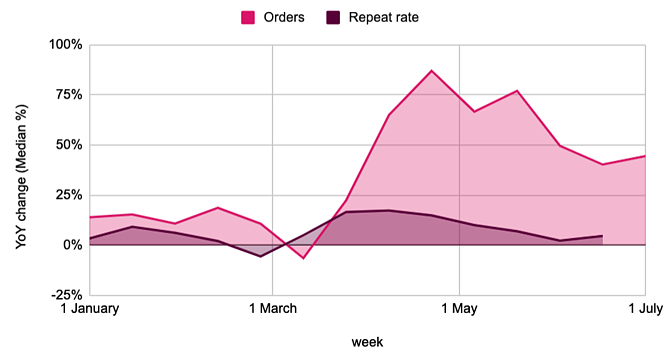

Fashion

Customer acquisition and online orders

Fashion brands became a Stay-at-Home Hero of the pandemic. By mid-April, consumer demand for loungewear and Zoom-appropriate outfits (read: a nice top and pyjama bottoms) soared.

By late April, online sales for fashion brands were up 87% YoY.

Despite a temporary decline going into May, online orders picked back up as people treated themselves to summer clothes for the warm weather. A similar, though weaker, trend can be seen again in June, perhaps as people prepared their outfits for a trip to the pub on Super Saturday.

Repeat rate

Before the pandemic, a smaller proportion of customers bought again from our fashion brand clients compared to last year.

The Coronavirus changed that.

From the first week of March, the repeat rate rapidly increased to peak at +17% YoY. It held steady here for most of April, when customers had no alternative to online shopping, before steadily declining from May onwards.

Right now, online orders for our fashion brand clients are up 45% YoY. While this trend looks set to remain substantially higher than last year, the repeat rate will soon fall below last year’s levels.

While shops re-opening may have contributed to this decline, it isn’t the only reason.

Many retailers have turned to discounts to drive sales in the current economic climate. This means money-conscious consumers may be shopping around for the best deal, rather than staying loyal to brands. The declining repeat rate doesn’t mean they’re not buying from fashion brands online at all, but that they’re not buying from the same fashion brands. This theory also explains the steady incline in orders and new customer acquisition from mid-June onwards.

This highlights the importance of brands engaging with their customers to earn their loyalty and motivate them to return. Even when they can get a cheaper deal elsewhere.

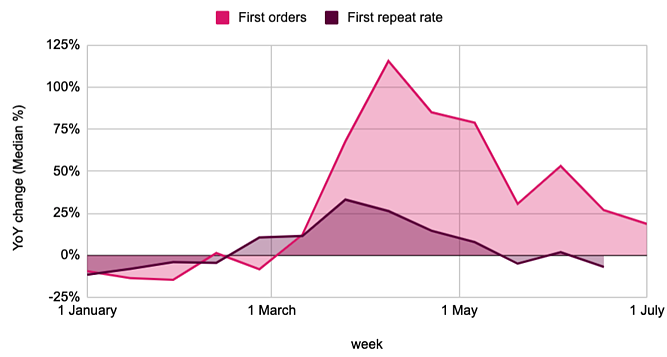

Health and Beauty

Customer acquisition and online orders

Of all the sectors, health and beauty has seen the biggest difference between the behaviour of new customers compared to those acquired pre-Covid.

Health supplements and skincare products flew into shoppers’ online baskets as self-care became a top priority. During lockdown, health and beauty brands acquired +75% new customers YoY.

Despite a sudden increase in late May, online orders for these brands are now sharply decreasing, though remain up 18% YoY.

However, physical stores no longer present as much of a threat to online retailers as pre-Covid. The in-store beauty experience is now very different – you can’t, for example, have someone apply a make-up sample or try out tester products. For online health and beauty brands that engage with new customers in the right ways, opportunity to sustain growth remains.

Repeat rate

During lockdown, many customers bought from health and beauty brands multiple times. At its peak in April, new customers were 33% more likely to repeat purchase compared to the same period last year.

Not anymore.

Now, a smaller proportion of new customers are returning to health and beauty brands than last year. The repeat rate across new customers for our clients in this sector currently sits at -7% YoY and is set to decline further.

It’s worth noting that this trend doesn’t apply to all our clients in this sector. The repeat rate across all customers in this sector (versus customers acquired since Covid) is the same as last year, although we expect this to decrease.

This highlights how differently customers acquired during lockdown behave. To persuade them to return, health and beauty brands must learn about these new segments of customers and engage with them in a way that resonates with their needs and desires.

Gifts and Occasion

Customer acquisition and online orders

Online orders for gifts went through the roof during lockdown, peaking at +159% YoY before steadying at +100%. Its current upwards trajectory suggests people are continuing to discover and buy from online brands in this sector.

It also suggests that people aren’t only buying gifts for occasions. Order volumes for our clients in the gift sector increased after Easter. Instead of physically seeing friends and family, consumers turned to ecommerce gift brands to send their love from afar.

Repeat rate

At present, gifts and occasion brands have the strongest customer retention rate of all the sectors. Its repeat rate peaked at +66% YoY early in lockdown and, despite declining since, has remained high. It currently sits at +38% YoY.

This can be partially explained by people buying gifts online, rather than in-store, for Mother’s Day and Easter (it’s also worth noting that Easter falls on different dates each year). And it reiterates that people are sending gifts to loved ones during a difficult time when they can’t physically be together.

We predict this strong repeat rate to continue alongside restrictions preventing some people seeing loved ones (such as relatives who live abroad or are vulnerable). Buying a gift for someone that can be delivered directly to their door makes for a far easier – and less risky – option than going to a store then hand-delivering it.

A balanced focus on both new customer acquisition and retention will sustain growth for brands in this sector.

The Verdict

It’s early days, but recent shopping activity in brick-and-mortar stores suggests the shift to ecommerce is permanent.

The in-store experience is different to pre-Covid. Customers must follow one-way systems, keep their distance from others, and try clothes on at home. 40% of those who have recently shopped in-store said they found the experience less enjoyable than before Covid.

The demographics that most prefer the physical shopping experience – baby boomers and traditionalists – are those most likely to be taking precautions against the virus. For many, shopping in-store for items that can be ordered at home seems an unnecessary risk.

The return to in-store shopping was always likely to be gradual. But the more time passes, the more consumers grow used to shopping online. This is reflected by the continued strong online activity for garden brands, which faced competition from garden centres a month before other shops reopened.

To continue along the track of strong business growth, online retailers must focus on building meaningful relationships with their customers. Physical stores aren’t the only threat; other online retailers also present strong competition. Customers acquired during lockdown are different to the rest of the customer base – brands must understand and adapt to this.

To avoid returning to pre-Covid growth levels (or worse), brands should forget taking the time to implement a perfect retention strategy. Instead, they should experiment with retention tactics now. Those that engage with their customers in the right ways to earn their loyalty will continue to enjoy the ride.

This post was previously published on the Mention Me blog.